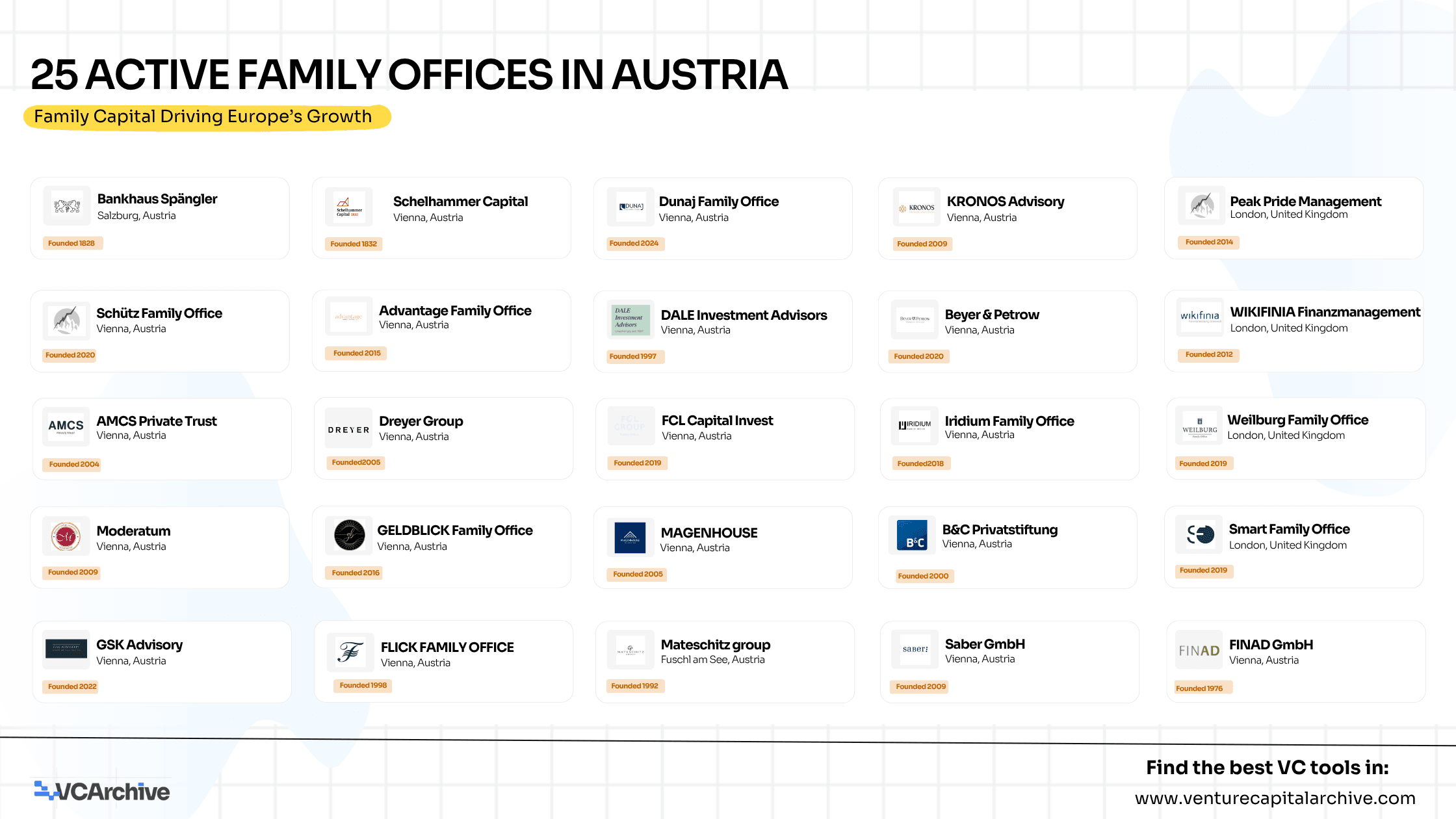

25 Active Family Offices in Austria

These 25 active family offices represent the country’s evolving wealth ecosystem, one built on discretion, generational trust, and a growing appetite for alternative assets. Their focus extends far beyond wealth preservation: they are allocating capital toward real estate, private equity, technology, and sustainability, sectors that blend reliability with reinvention.

1. Tradition and Trust: Austria’s Historic Family Banking Dynasties

Anchoring Austria’s private wealth landscape are heritage institutions like Bankhaus Spängler - the country’s oldest private bank, founded in Salzburg and still run by one of Austria’s historic banking families. Alongside it, Schelhammer Capital in Vienna carries forward a legacy of values-based investing, integrating Catholic banking traditions with sustainable finance and cross-border wealth management.

These long-established houses represent more than financial institutions; they are custodians of Austrian stability, offering independent advice and multigenerational wealth planning rooted in discretion, continuity, and deep client relationships.

2. The Modern Multi-Family Office: Structure, Strategy, and Scale

Vienna has quietly become a nucleus for modern multi-family offices, combining old-world private banking discipline with global investment scope.

Firms like DALE Investment Advisors, Moderatum, and FINAD GmbH exemplify this new sophistication, blending independent advisory with cross-border allocation, portfolio structuring, and long-term wealth preservation.

Peak Pride Management and Beyer & Petrow Family Office add a boutique dimension, offering personalized investment advisory and estate planning for complex family structures. Their strength lies in flexibility, curating diversified portfolios and ensuring continuity through tailored, values-aligned strategies.

3. Real Assets and Private Equity: Building Resilient Portfolios

Austrian family offices maintain a strong affinity for tangible wealth. Real estate and private equity dominate the portfolios of firms like Advantage Family Office, Smart Family Office, and Dreyer Group, which blend conservative capital management with growth-oriented diversification.

FCL Capital Invest and GELDBLICK Family Office mirror this balance, preserving wealth while selectively pursuing private equity and venture opportunities in Europe’s mid-market. Their patient, risk-adjusted approach reflects Austria’s broader ethos: to grow steadily, not speculatively.

4. Advisory-Driven Capital: From Succession Planning to Strategic Insight

Austria’s family offices increasingly function as strategic advisors as much as investors. Dunaj Family Office Consulting and KRONOS Advisory specialize in succession planning, governance, and multi-jurisdictional tax structuring, serving as trusted stewards through complex generational transitions.

Saber GmbH and GSK Advisory take this model further by blending corporate finance, strategic advisory, and concierge-style family services offering everything from deal structuring to lifestyle management. This hybrid model illustrates how Austria’s family offices have evolved beyond asset managers into full-service family enterprises.

5. Global Vision, Local Roots

While grounded in Austrian prudence, many of these offices operate globally. Weilburg Family Office and Iridium Family Office serve multi-country portfolios spanning Europe, the U.K., and Asia, integrating international exposure with local insight.

At the top tier, B&C Privatstiftung and Mateschitz Group (the family office behind Red Bull) stand as global powerhouses managing billions in strategic holdings, from industrial giants to media and sports assets. Their activity underscores Austria’s growing influence in international private capital, where disciplined governance meets global ambition.

The Shift in Austria’s Private Capital

Austria’s family offices reflect a quiet but powerful shift: from custodians of wealth to architects of change.

They are modernizing governance, embracing transparency, and deploying capital with strategic precision across Europe and beyond. What once operated behind gilded doors now shapes key industries. From real estate and renewables to technology and venture.

This evolution marks the rise of “active legacy capital” where wealth not only endures, but also participates in the future it helped build.

Explore the Full List

Discover the complete list of 25 Active Family Offices in Austria, including detailed insights on investment theses, portfolios, and co-investor networks, exclusively on VCArchive mapping how Austrian family capital continues to define Europe’s financial heritage and future innovation.

25 Active Family Offices in Austria